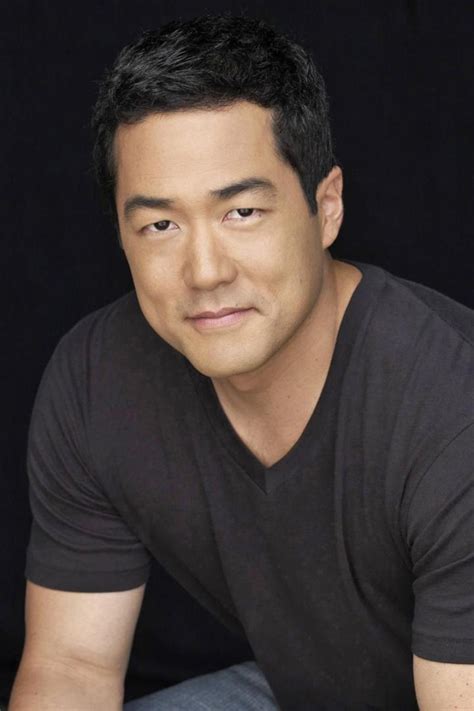

A Quote by Michael Burry

Common hedging techniques include shorting stocks, buying put options, writing call options, and various types of leverage and paired transactions. While I do reserve the right to use these tools if and when appropriate, my firm opinion is that the best hedge is buying an appropriately safe and cheap stock.

Related Quotes

People will make worse financial decisions for them if they're choosing from a lot of options than if they're choosing from a few options. If they have more options they're more likely to avoid stocks and put all their money in money market accounts, which doesn't even grow at the rate of inflation.