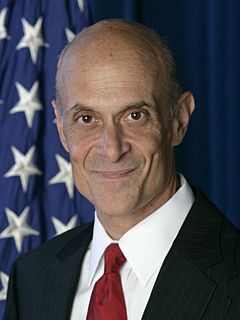

A Quote by Michael Chertoff

The second thing we did was said, OK, we've now identified the risk, but what do you want to do with the money? Because it's not enough to have risk; you've got to have a meaningful use for the money we give you.

Related Quotes

The reality of television production now is that all the development money and pilot money now goes to the Internet so they can try to get pilots cheaper, than if they were producing them for television. I understand, it's a business, but what's great about doing it on the web, and one thing that attracted me is the amount of creative freedom that you do get with the web. That's the only advantage of there not being a lot of money involved, is that you're really able to write and do what you want... because there's not a lot of money involved and not money at risk.

The music business is suffering because fewer artists are being invested in. Labels are putting in less money, taking fewer risks and signing half as many artists as they did 10 years ago. Everything is risk averse right now and there are two ways to deal with a business situation like this: either reduce your risk or increase your return. They're reducing their risk to the bone and looking for ways with their 360 deals to increase their return. They're still not making money. Artists are suffering. Labels, or music investors, are suffering.

Where you want to be is always in control, never wishing, always trading, and always first and foremost protecting your ass. That's why most people lose money as individual investors or traders because they're not focusing on losing money. They need to focus on the money that they have at risk and how much capital is at risk in any single investment they have. If everyone spent 90 percent of their time on that, not 90 percent of the time on pie-in-the-sky ideas on how much money they're going to make, then they will be incredibly successful investors.

To walk in money through the night crowd, protected by money, lulled by money, dulled by money, the crowd itself a money, the breath money, no least single object anywhere that is not money. Money, money everywhere and still not enough! And then no money, or a little money, or less money, or more money but money always money. and if you have money, or you don't have money, it is the money that counts, and money makes money, but what makes money make money?

To laugh is to risk appearing a fool. To weep is to risk appearing sentimental. To reach out to another is to risk involvement. To expose feelings is to risk exposing your true self. To place your ideas and dreams before a crowd is to risk their loss. To love is to risk not being loved in return. To hope is to risk pain. To try is to risk failure. But risks must be taken, because the greatest hazard in life is to risk nothing.

Anyway, when I got out of the Army, I went to see a therapist. And she said, what seems to be the trouble? And I said I want to give all my money away. And she said, how much do you have? And I said, I owe $300. She stared at me for several seconds, and she said, I see. Well, let's get to work. And maybe by the time you do have some money, you'll be wise enough to know what to do with it.

We regard using [a stock's] volatility as a measure of risk is nuts. Risk to us is 1) the risk of permanent loss of capital, or 2) the risk of inadequate return. Some great businesses have very volatile returns - for example, See's [a candy company owned by Berkshire] usually loses money in two quarters of each year - and some terrible businesses can have steady results.

That's exactly what I'm driving at. 'Basterds' was interesting because it was, in a way, unfamiliar. I thought well, OK. Let's leave the comfort zone and just risk it. Why not? Because, exactly as you said, in a way, by taking that risk, I make up a little bit for my ignorance in the subject, or rather, the genre.