A Quote by Michael Covel

Do not let emotions fluctuate with the up and down of your capital.

Related Quotes

If, for example, each of us had the same share of capital in the national total capital, then if the share of capital goes up it's not a problem, because you get as much as I do. The problem is that capital in capitalist countries is very heavily concentrated, especially financial capital. So then if the share of income from that source goes up, that actually exacerbates inequality.

Negative emotions will challenge your grit every step of the way. While it's impossible not to feel your emotions, it's completely under your power to manage them effectively and to keep yourself in a position of control. When you let your emotions overtake your ability to think clearly, it's easy to lose your resolve.

Kids don't say, "Wait." They say, "Wait up, hey wait up!" Because when you're little, your life is up. The future is up. Everything you want is up. "Hold up. Shut up! Mum, I'll clean up. Let me stay up!" Parents, of course, are just the opposite. Everything is down. "Just calm down. Slow down. Come down here! Sit down. Put... that... down."

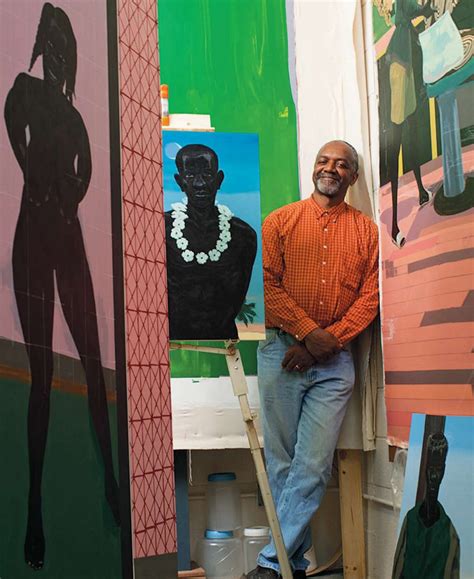

In real estate you can avoid ever having to pay a capital gains tax, decade after decade, century after century. When you sell a property and make a capital gain, you simply turn around and buy a new property. The gain is not taxed. It's called "preserving your capital investment" - which goes up and up in value with each transaction.