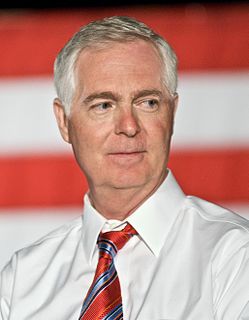

A Quote by Michael F. Easley

I had hoped to let the one-half cent sales tax sunset this year, but we do not believe revenues will grow as fast as we hoped for the rest of the year.

Related Quotes

The Value-Added Tax, a sales tax that applies at every level of business transactions, is an easy tax for governments to collect, and a hard tax to evade. So it makes the job of raising revenue easier. The revenues from the VAT can then be used to lower taxes on income and saving and investment. The Value-Added tax doesn't penalize work or saving; it's a tax on buying stuff.

It was not the case that one thing morphed into another, child into woman. You remained the person you were before things happened to you. The person you were when you thought a small cut string could determine the course of a year. You also became the person to whom certain things happened. Who passed into the realm where you no longer questioned the notion of being trapped in one form. You took on that form, that identity, hoped for its recognition from others, hoped someone would love it and you.

God forbid that the United Kingdom should take a lead and introduce a sensible tax system of its own which would probably comprise a very low level of corporation tax - tax on corporate profits - and perhaps a low level of corporate sales tax, because sales are where they are, and sales in this country are sales here, which we can tax here.

You are smart people. You know that the tax cuts have not fueled record revenues. You know what it takes to establish causality. You know that the first order effect of cutting taxes is to lower tax revenues. We all agree that the ultimate reduction in tax revenues can be less than this first order effect, because lower tax rates encourage greater economic activity and thus expand the tax base. No thoughtful person believes that this possible offset more than compensated for the first effect for these tax cuts. Not a single one.