A Quote by Michael Hudson

The bank's product is debt, because the banks want to make sure that they can get paid for the debt. But ultimately the only party that can pay the debt is the government, because it runs the printing presses. So the debts ultimately either are paid by the government, or they're paid by a huge transfer of property from debtors to creditors - or, the debts are written off.

Related Quotes

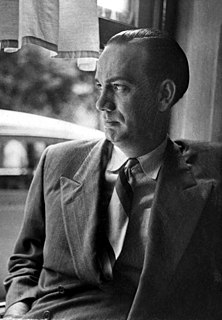

My mother was being hounded by a debt collector over a debt that she didn't owe, and she eventually just paid it because she wanted the calls to stop. I was very surprised. It sounded so strange. I started poking around on the internet and found this was extremely common. There was this world where these debts were sold off by the banks for pennies on the dollar and bought and sold.

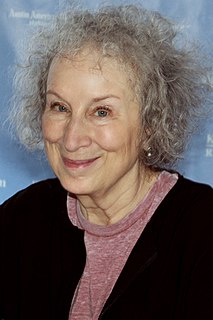

In Heaven, there are no debts - all have been paid, one way or another - but in Hell there's nothing but debts, and a great deal of payment is exacted, though you can't ever get all paid up. You have to pay, and pay, and keep on paying. So Hell is like an infernal maxed-out credit card that multiplies the charges endlessly.

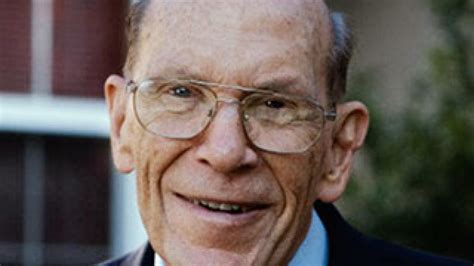

Shipping first time code is like going into debt. A little debt speeds development so long as it is paid back promptly with a rewrite. The danger occurs when the debt is not repaid. Every minute spent on not-quite-right code counts as interest on that debt. Entire engineering organizations can be brought to a standstill under the debt load of an unconsolidated implementation, object-oriented or otherwise.

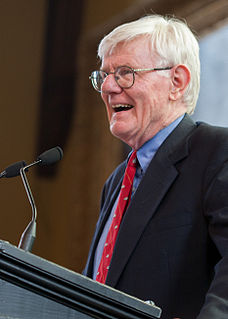

There are two definitions of deflation. Most people think of it simply as prices going down. But debt deflation is what happens when people have to spend more and more of their income to carry the debts that they've run up - to pay their mortgage debt, to pay the credit card debt, to pay student loans.

Debt settlement companies work as a middleman between you and your creditor. If all goes well (and that's a big if), you should be able to settle your debts for cents on the dollar. You'll also pay a fee to the debt settlement company, usually either a percentage of the total debt you have or a percentage of the total amount forgiven.