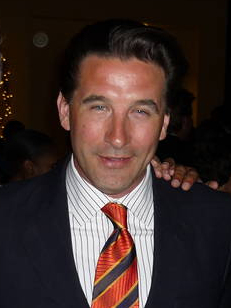

A Quote by Michael Hudson

Actually, high housing prices don't help the economy. They raise the cost of living.

Related Quotes

The real story in housing will be a recovery in the economy that will drive a recovery in housing, When people are working, when there are more jobs, more households forming and people go back to buying cars, they're going to want their apartments and homes. And that's when you'll start to see a recovery in home prices.

So, what people are actually left with to spend is maybe 25 to 30% of their income on goods and services, after paying taxes and after paying the FIRE sector (Finance, Insurance, Real Estate). Whether it's housing insurance or mortgage insurance. So there's an idea of distracting people. Don't think of your condition. Think of how the overall economy is doing. But don't think of the economy as an overall unit. Think of the stock market as the economy. Think of the rich people as the economy. Look at the yachts that are made. Somebody's living a lot better. Couldn't it be you?