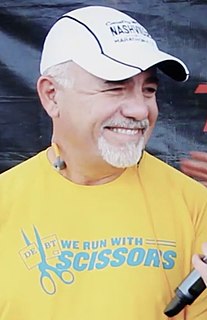

A Quote by Michael Hudson

The current U.S. and Eurozone depression isn't because of China. It's because of domestic debt deflation. Commodity prices and consumer spending are falling, mainly because consumers have to pay most of their wages to the FIRE sector for rent or mortgage payments, student loans, bank and credit card debt, plus over 15 percent FICA wage withholding for Social Security and Medicare actually, to enable the government to cut taxes on the higher income brackets, as well income and sales taxes.

Quote Topics

Actually

Bank

Because

Brackets

Card

China

Commodity

Commodity Prices

Consumer

Consumers

Credit

Credit Card

Credit Card Debt

Current

Cut

Debt

Deflation

Depression

Domestic

Enable

Eurozone

Falling

Fire

Government

Higher

Income

Loans

Mainly

Medicare

Mortgage

Most

Over

Pay

Payments

Percent

Plus

Prices

Rent

Sales

Sales Tax

Sector

Security

Social

Social Security

Spending

Student

Student Loan

Student Loans

Taxes

Wage

Wages

Well

Withholding

Related Quotes

There are two definitions of deflation. Most people think of it simply as prices going down. But debt deflation is what happens when people have to spend more and more of their income to carry the debts that they've run up - to pay their mortgage debt, to pay the credit card debt, to pay student loans.

If you have to pay about forty to forty-three percent of your income for housing, you also have to pay fifteen percent of your paycheck for the FICA for Social Security wage withholding. You have to pay medical care, you have to pay the banks for your credit card debt, student loans. Then you only have about twenty-five or thirty-five percent, maybe one-third of your salary to buy goods and services. That's all.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

So we are in for years of debt deflation. That means that people have to pay so much debt service for mortgages, credit cards, student loans, bank loans and other obligations

that they have less to spend on goods and services. So markets shrink. New investment and employment fall off, and the economy is falls into a downward spiral.

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.

If you have credit card debt and credit card companies continue to close down the cards, what are you going to do? What are you going to do if they raise your interest rates to 32 percent? That's five times higher than what your kid is going to pay in interest on a student loan. Get rid of your credit card debt.

Reform immigration to make it easy for individuals to come over here, be documented, pay taxes - immigration reform is needed to state that its about work, its not about welfare... Set up a grace period where they can get a work permit... social security card so that they can pay income tax, social security, Medicare.

There is a lot of fiscal conservatives in the United States senate that didn't vote for that because we understand that national security spending is not the reason why we have a debt. Our debt is being driven by the way Social Security, Medicare, and Medicaid and, by the way, the interest on the debt is structured in the years to come.

By the standards of honest, if unorthodox, accounting, government workers don't pay taxes, but are paid out of taxes. In other words, they pay taxes out of money confiscated from taxpayers, who, in turn, pay taxes twice: on their own income and on the income of members of the bureaucracy. At the very least, this should disqualify state workers from voting.

Debt is so ingrained into our culture that most Americans can't even envision a car without a payment ... a house without a mortgage ... a student without a loan ... and credit without a card. We've been sold debt with such repetition and with such fervor that most folks can't conceive of what it would be like to have NO payments.