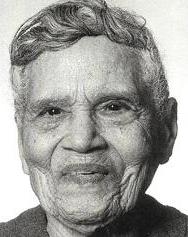

A Quote by Michael Hudson

Today, people are having to spend so much of their money, to acquire a house and to get an education that they don't have enough to spend on goods and services, except by running into yet more debt on their credit cards and other borrowings.

Related Quotes

So we are in for years of debt deflation. That means that people have to pay so much debt service for mortgages, credit cards, student loans, bank loans and other obligations

that they have less to spend on goods and services. So markets shrink. New investment and employment fall off, and the economy is falls into a downward spiral.

If you want to spend more money in restaurants, use credit cards more than cash. If you want to spend less, use cash more than credit cards. But in general, we can think about how to use the pain of paying and how much of it do we want. And I think we have like a range. Credit cards have very little pain of paying, debit cards have a little bit more because you feel like today, at least it is coming out of your checking account, and cash has much more.

What do the 5%, or the 1% actually use their money for? They lend it back to the economy at large, they load it down with debt. They make their money by lending to the bottom 95%, or the bottom 99%. When you give them more after-tax income, it enables them to buy even more control of government, even more control of election campaigns. They're not going to spend this money back into the goods-and-services economy.

The world is a puzzling place today. All these banks sending us credit cards, with our names on them. Well, we didn't order any credit cards! We don't spend what we don't have. So we just cut them in half and throw them out, just as soon as we open them in the mail. Imagine a bank sending credit cards to two ladies over a hundred years old! What are those folks thinking?

People have to pay so much money to the banks that they don't have enough money to buy the goods and services they produce. So there's not much new investment, there's not new employment (except minimum-wage "service" jobs), markets are shrinking, and people are defaulting. So many companies can't pay their banks.

When the government takes more money out of the pockets of middle class Americans, entrepreneurs, and businesses, it lessens the available cash flow for people to spend on goods and services, less money to start businesses, and less money for businesses to expand - i.e. creating new jobs and hiring people.