A Quote by Michael Hudson

Income is sucked upward to the creditors, who then foreclose on the assets of debtors. This shrinks tax revenue, forcing public budgets into deficit. And when governments are indebted, they becomemore subject to pressure to privatization of public enterprise.

Related Quotes

The Value-Added Tax, a sales tax that applies at every level of business transactions, is an easy tax for governments to collect, and a hard tax to evade. So it makes the job of raising revenue easier. The revenues from the VAT can then be used to lower taxes on income and saving and investment. The Value-Added tax doesn't penalize work or saving; it's a tax on buying stuff.

I think the problem is, if we foreclose any public justice, then we cut off the virtuous cycle that's represented by law, where there are public decisions which then deter misconduct in the future. We need to have both. We need to have private dispute sy-, systems, and we need to have public dispute systems.

Indeed the three policy pillars of the neoliberal age-privatization of the public sphere, deregulation of the corporate sector, and the lowering of income and corporate taxes, paid for with cuts to public spending-are each incompatible with many of the actions we must take to bring our emissions to safe levels.

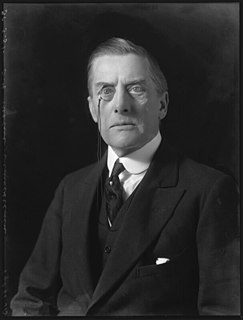

[I believe in] the throne...parliamentary institutions...private enterprise and individual opinion against the socialization of the state...equity in the distribution of public burdens and strict maintenance of public faith with the creditors of the state [and] a fresh guarantee of peace by an alliance with France and...Belgium for the defence of our common interests against unprovoked attack.