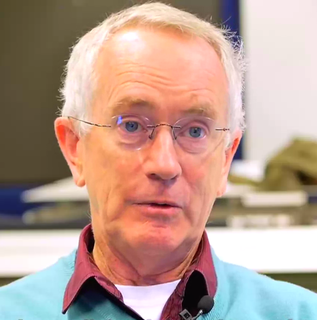

A Quote by Michael Hudson

People think of a business cycle, which is a boom followed by a recession and then automatic stabilizers revive the economy. But this time we can't revive. The reason is that every recovery since 1945 has begun with a higher, and higher level of debt. The debt is so high now, that since 2008 we've been in what I call, debt deflation.

Related Quotes

If you have a sane economy, and by sane economy I mean one which is not addicted to debt, not a Ponzi economy, then the change in debt each year should contribute a minor amount to demand. Therefore, if you tried to correlate debt to the level of unemployment you would not find much of a correlation. Unfortunately that is not the economy we live in.

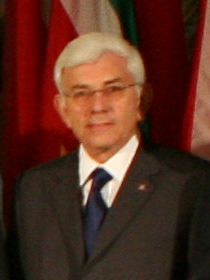

The PUP came into office in 1998 when the public debt of Belize was over $600 million and the economy was at a standstill. When we left office in 2008, ten years later, the debt was higher, but a lot was accomplished: the economy was transformed and the social and physical infrastructure of the country significantly upgraded.

There are two definitions of deflation. Most people think of it simply as prices going down. But debt deflation is what happens when people have to spend more and more of their income to carry the debts that they've run up - to pay their mortgage debt, to pay the credit card debt, to pay student loans.

Debt is a trap, especially student debt, which is enormous, far larger than credit card debt. It’s a trap for the rest of your life because the laws are designed so that you can’t get out of it. If a business, say, gets in too much debt it can declare bankruptcy, but individuals can almost never be relieved of student debt through bankruptcy.

Debt is a trap, especially student debt, which is enormous, far larger than credit card debt. It's a trap for the rest of your life because the laws are designed so that you can't get out of it. If a business, say, gets in too much debt, it can declare bankruptcy, but individuals can almost never be relieved of student debt through bankruptcy.

Shipping first time code is like going into debt. A little debt speeds development so long as it is paid back promptly with a rewrite. The danger occurs when the debt is not repaid. Every minute spent on not-quite-right code counts as interest on that debt. Entire engineering organizations can be brought to a standstill under the debt load of an unconsolidated implementation, object-oriented or otherwise.

The Bankruptcy Reform Act of 2005 made it harder for individuals to file bankruptcy, which is always the last resort. Unfortunately, simultaneously consumers racked up so much debt that counseling companies - which are higher up on my list if you need help managing your debt - are sometimes unable to help. So if you fall into this camp, debt settlement may be something to consider.

So we are in for years of debt deflation. That means that people have to pay so much debt service for mortgages, credit cards, student loans, bank loans and other obligations

that they have less to spend on goods and services. So markets shrink. New investment and employment fall off, and the economy is falls into a downward spiral.