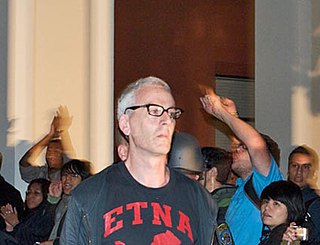

A Quote by Michael Hudson

Today's national income statistics make it appear that Goldman Sachs is productive. As if Donald Trump plays a productive role. The aim is to make it appear that people who take money from the rest of the economy without working are productive, despite not really providing any service that actually contributes to GDP and economic growth.

Related Quotes

People think that this concept of GDP is scientific economics, partly because it has a precise number and can be quantified. But the underlying concept of "the market" makes it appear as if today's poverty is natural. It makes it appear that Goldman Sachs and Donald Trump are job creators instead of job destroyers. That is illogical, when you think about it.

The concept of productivity in America is income divided by labor. So if you're Goldman Sachs and you pay yourself $20 million a year in salary and bonuses, you're considered to have added $20 million to GDP, and that's enormously productive. So we're talking in a tautology. We're talking with circular reasoning here.

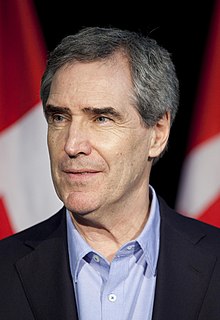

We can't afford to waste people. We can't afford to have people think the game is over before it's begun. We've got to be saying to the Canadian people: you can't tax cut your way to a productive 21st-century economy. You can talk that talk, but it's not going to give you a productive 21st-century economy, because it will scythe apart the public goods that make prosperity possible. That's what we've got to say, and so we shall.

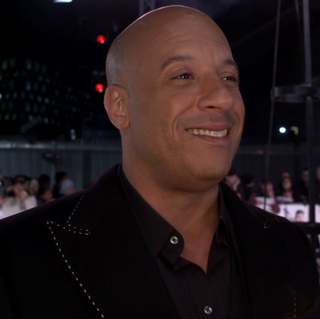

I started acting at seven years old. It took me 20 years to understand that if I was going to make my dreams a reality, I had to take the reigns. I had to learn something about being productive and being self what's the word I'm looking for? Self-sufficient, but I had to be productive at all costs and I had to make product.

Because I wrote a book about Goldman Sachs. And I know that, from talking to people at Goldman Sachs, that Trump is the poster child for the kind of client they don't want to do business with, mainly because he would borrow all this money from Wall Street to build his casinos, and then didn't pay it back.

I don't want to overvalue Donald Trump as some historical rupture, and to admit that I do think Trump is an indication of a fairly profound change. But the change started a while ago, and it has taken a while to appear. Global capital, particularly western capital, has been in decline since the late 60s and early 70s. The softness appeared in the 60s, the profit rate fell off the table in 1972 - 73, and there have been very uneven recoveries. This has been an ongoing weakening of the productive economy of accumulation at a global scale, of capital's capacity to expand.