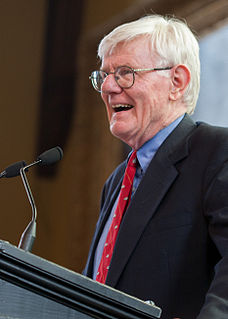

A Quote by Michael Hudson

If bankers can push the loans and make more profits for the bank, they get paid higher bonuses. They often also get stock options. If the bank goes under, they get to keep all of these salaries and options - and the government will bail out the bank. These guys will take their money and run, which is pretty much what they're doing now.

Related Quotes

When you say "bank," a bank is a building, a set of computers and chairs and things. The bankers are the people running these banks. They're the chief officers, and they push the loans because they don't care if they go bad. For one thing, they may package these bad loans and sell them off to gullible institutional investors.

I went to the library and learned how checks work. I found out that routing numbers are like zip codes: the checks are sent to the bank that correlates to the routing number. If I manipulate those numbers to a bank far away, it would take longer to get back to the bank, which gave me more time to write more bad checks.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

I want to work in a bank, definitely. Hopefully, my acting career will go well. But if it doesn't, I go to a bank. If it does, then even at the age of 40, I will still go to a bank, but I have to work in a bank, because I'm really fond of taxation and accounts and investments and all of that. So I will do it. At some point, I will, yes.

What's the best gamble in the world, right now? Its betting that Deutsche Bank stock is going to go down. Short sellers borrowed money from their banks to place bets that Deutsche Bank stock is going to go down. Now, it's wringing its hands and saying, "Oh the speculators are killing us." But it's Deutsche Bank and the other banks that are providing the money to the speculators to bet on credit.

The Koreans that make their money in our community: If we have a Black bank, you'll find they don't deposit anything of what they take from us into a Black bank that would serve our community. They set up a bank in their own community. The Honorable Elijah Muhammad, my Teacher, called people like this "Bloodsuckers of the poor." All they want is to make a dollar, and run.