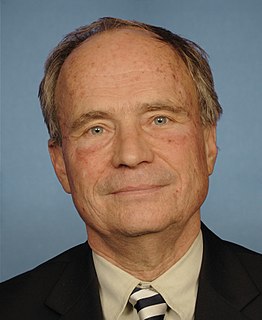

A Quote by Michael J. Boskin

Anyone interested in the past, present, or future of banking and financial crises should read The Bankers' New Clothes. Admati and Hellwig provide a forceful and accessible analysis of the recent financial crisis and offer proposals to prevent future financial failures. While controversial, these proposals--whether you agree or disagree with them--will force you to think through the problems and solutions.

Quote Topics

Accessible

Agree

Analysis

Anyone

Bankers

Banking

Clothes

Controversial

Crises

Crisis

Disagree

Failures

Financial

Financial Crisis

Financial Failure

Force

Forceful

Future

In The Past

Interested

New

New Clothes

Offer

Past

Present

Prevent

Problems

Problems And Solutions

Proposals

Provide

Read

Recent

Should

Solutions

Them

Think

Through

Whether

While

Will

Related Quotes

In the immediate postwar era, financial crises in advanced countries were rare events, and before 1970 did not happen at all. Since then they have occurred more often, and 2008 was the most damaging of them all to date. If we have moved back to a regime of regular financial crises - like the one we had from the 1870s to the 1930s - then our economic future will be very different from our recent past.

As the worldly philosophers of the past affirmed, the goal of economics is to improve the way society functions. In The New Financial Order, Robert Shiller joins this proud tradition by directing his brilliant economic skills toward the creation of financial institutions designed to reduce the risks an unknown future visits on most members of our society and others. Shiller's imaginative and compelling analysis will appeal to all readers who share his passion for initiating not only a richer, but a better, century.

People look at the future and see a black hole. They look at climate change and see an ecological crisis. They look at their leaders corrupted by money and see a political crisis. They wonder if they'll ever be able to pay off their student loan or own a house. Given this ecological, political and financial crisis, what they want is a different future. Their fundamental demand is a different regime to provide that future.