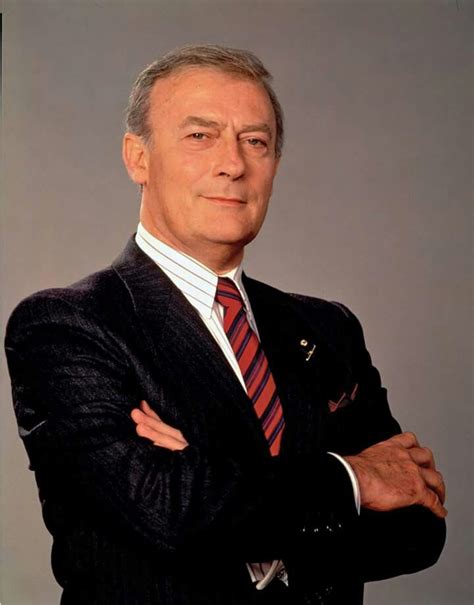

A Quote by Michael Lewis

Everywhere you turn you see Americans sacrifice their long-term interests for a short-term reward.

Related Quotes

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.

Being captive to quarterly earnings isn't consistent with long-term value creation. This pressure and the short term focus of equity markets make it difficult for a public company to invest for long-term success, and tend to force company leaders to sacrifice long-term results to protect current earnings.

With my eyes closed, I ask if she knows how this will all turn out. "Long-term or short-term?" she asks. Both. "Long-term," she says, "we're all going to die. Then our bodies will rot. No surprise there. Short-term, we're going to live happily ever after." Really? "Really," she says. "So don't sweat it.

If Ibsen's 'Enemy of the People' were alive today, he would recognize the ethic that has informed capitalist and communist countries alike - economic growth before public health and well-being. The true enemies of the people ar those who continue to sacrifice our long-term interests for short-term gains. But perhaps we should all look in the mirror.