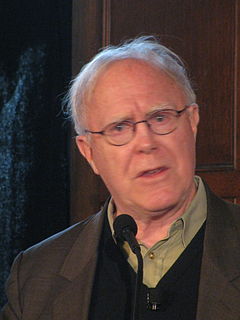

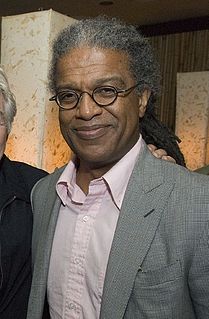

A Quote by Michael Parenti

The rich have grown richer, but their tax rate has declined. The poor have grown poorer, but their taxes have increased.

Related Quotes

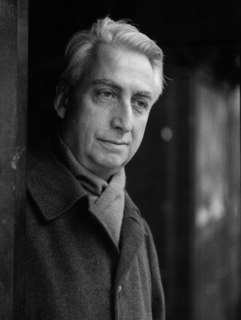

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

The essence of capitalism is expressed in two of its basic features: a) profit maximization and b) market competition. In their abstract formulations none of them was supposed to have anything conspiratorial against the poor. But in real life they turn out to be the "killers" of the poor - by making rich the richer and poor the poorer.

My definition of a decent society is one that first of all takes care of its losers, and protects its weak. What I see in my country, progressively over these years, is that the rich have got richer, the poor have got poorer. The rich have become indifferent through a philosophy of greed, and the poorer have become hopeless because they're not properly cared for. That's actually something that is happening in many Western societies. Your own, I am told, is not free from it.

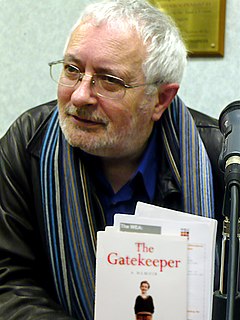

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.