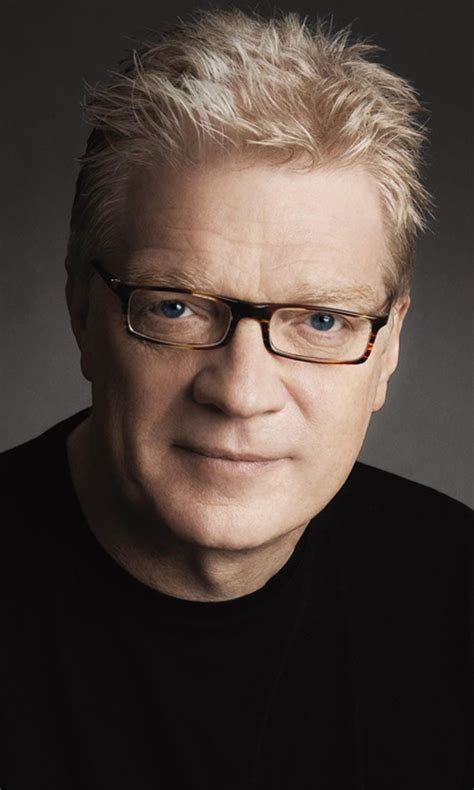

A Quote by Michael Pollan

It's estimated that about 30 percent of the increase in grain prices could be attributed to the decision to embrace biofuels, particularly corn-based ethanol. It has done nothing for climate change and the business is in real trouble now with the collapse of oil prices. It's completely dependent on a dollar subsidy and tariff from the government.

Related Quotes

High prices can be the result of speculation, and maybe plunging prices can be attributed to the end of speculation, but low prices over time aren't caused by speculation. That's oversupply, mainly by Saudi Arabia flooding the market with low-priced oil to discourage rival oil producers, whether it's Russian oil or American fracking.

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.

Exporting oil would not drive up prices at the pump. American drivers buy refined products, which the U.S. already exports. Many studies - from a range of institutions and government agencies, including the Congressional Budget Office and the Energy Information Administration - have shown that lifting the export ban could actually lower gas prices.

Renewable biofuels are meanwhile making inroads in the transportation fuels market and are beginning to have a measurable impact on demand for petroleum fuels, contributing to a decline in oil consumption in the United States in particular starting in 2006... The 93 billion liters of biofuels produced worldwide in 2009 displaced the equivalent of an estimated 68 billion liters of gasoline, equal to about 5 percent of world gasoline production.