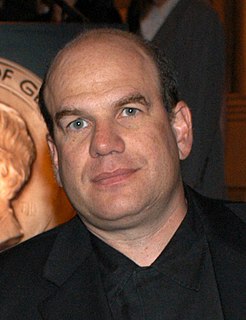

A Quote by Michael Schur

People think of taxes as money just being robbed from you. They don't consider the benefits of paying taxes. The benefits that they get and also the benefit of just being a part of a large group of people: a town, or a city, or a country, or a society that allegedly should stand together and all try to help each other.

Related Quotes

I'm making a lot of money. I should be paying a lot more taxes. I'm not paying taxes at a rate that is even close to what people were paying under Eisenhower. Do people think America wasn't ascendant and wasn't an upwardly mobile society under Eisenhower in the '50s? Nobody was looking at the country then and thinking to themselves, "We're taxing ourselves into oblivion." Yet there isn't a politician with balls enough to tell that truth because the whole system has been muddied by the rich. It's been purchased.

A lot of people in the western world don't realize how much taxes limit their options. You can end up paying almost half your income in taxes, which basically means you're working for the government for 180 days a year. I think I can find better ways to use the money I make for the benefit of society.

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.

The state of New York's got this group of people called smokers, and they know they're addicted, and despite all the efforts to make 'em quit, they know they can't. So they just see a pile of money when they see these people. And they think because they're addicted, they can't not buy the product, so they just keep raising taxes and raising taxes, and they expect people just to come up with the money from somewhere and pay it.

First, undoubtedly, there are some people who are coming from Cuba who immediately, or from any other country, benefit. But, what is the difference between that and someone who is coming from Nicaragua, Guatemala, Mexico, etc.? That is, we are simply going to say that someone who comes from another country to the United States - the first five years they're here - they don't qualify for federal benefits. They may benefit from local benefits, state benefits. Those decisions belong to other jurisdictions.

When you pay social security taxes, you are in no way making provision for your own retirement. You are paying the pensions of those who are already retired. Once you understand this, you see that whether you will get the benefits you are counting on when you retire depends on whether Congress will levy enough taxes, borrow enough, or print enough money.

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.