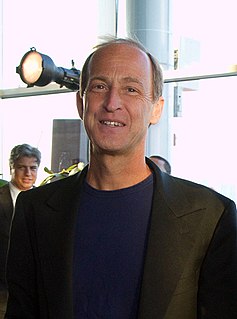

A Quote by Michael Spence

There is no question that the recovery from the global recession triggered by the 2008 financial crisis has been unusually lengthy and anemic.

Quote Topics

Related Quotes

I think the ethos for Gov. Romney is to use a whole variety of policies, of which tax policy is one, to try to raise the rate of growth. We've had a recovery from the financial crisis that would be well below what one might normally expect for a recovery from such a deep recession. And to counteract that we need better tax policy.

Since the global financial crisis and recession of 2007-2009, criticism of the economics profession has intensified. The failure of all but a few professional economists to forecast the episode - the aftereffects of which still linger - has led many to question whether the economics profession contributes anything significant to society.

It is no exaggeration to say that since the 1980s, much of the global financial sector has become criminalised, creating an industry culture that tolerates or even encourages systematic fraud. The behaviour that caused the mortgage bubble and financial crisis of 2008 was a natural outcome and continuation of this pattern, rather than some kind of economic accident.