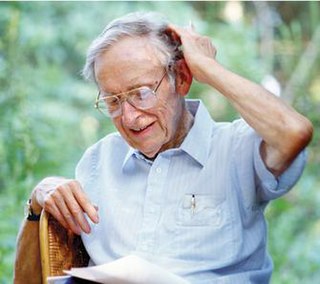

A Quote by Michael Spence

Actions aimed at supporting deleveraging and balance-sheet repair - such as recognizing losses, writing down assets, and recapitalizing banks - carry longer-term benefits but short-term costs.

Related Quotes

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.

Any strategy that involves crossing a valley accepting short-term losses to reach a higher hill in the distance will soon be brought to a halt by the demands of a system that celebrates short-term gains and tolerates stagnation, but condemns anything else as failure. In short, a world where big stuff can never get done.