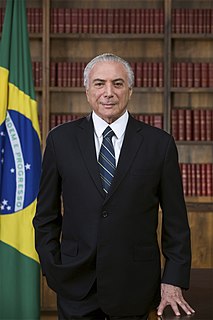

A Quote by Michel Temer

It was an important and daring decision to open Eletrobras capital to private investors.

Related Quotes

State funds, private equity, venture capital, and institutional lending all have their role in the lifecycle of a high tech startup, but angel capital is crucial for first-time entrepreneurs. Angel investors provide more than just cash; they bring years of expertise as both founders of businesses and as seasoned investors.

A global financial cabal engineered a fraudulent housing and debt bubble [2008], illegally shifted vast amounts of capital out of the US; and used 'privatization' as a form of piracy - a pretext to move government assets to private investors at below-market prices and then shift private liabilities back to government at no cost to the private liability holder Clearly, there was a global financial coup d'etat underway.

Too often, investors are the target of fraudulent schemes disguised as investment opportunities. As you know, if the balance is tipped to the point where investors are not confident that there are appropriate protections, investors will lose confidence in our markets, and capital formation will ultimately be made more difficult and expensive.

Index funds are... tax friendly, allowing investors to defer the realization of capital gains or avoid them completely if the shares are later bequeathed. To the extent that the long-run uptrend in stock prices continues, switching from security to security involves realizing capital gains that are subject to tax. Taxes are a crucially important financial consideration because the earlier realization of capital gains will substantially reduce net returns.

If you're going to lead a space frontier, it has to be government; it'll never be private enterprise. Because the space frontier is dangerous, and it's expensive, and it has unquantified risks. And under those conditions, you cannot establish a capital-market evaluation of that enterprise. You can't get investors.