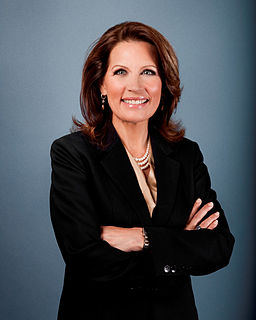

A Quote by Michele Bachmann

I get how devastating high taxes are to job creation.

Quote Topics

Related Quotes

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.

The left does understand how raising taxes reduces economic activity. How about their desire for increasing cigarette taxes, soda taxes? What are they trying to do? Get you to buy less. They know. They know that higher taxes reduce activity. It's real simple: If you want more of an activity, lower taxes on it. If you want less of an activity, raise taxes. So if you want more jobs? It's very simple. You lower payroll taxes. If you don't want as many jobs, then you raise corporate taxes. It's that simple, folks.

Governments should end the extreme concentration of wealth in order to end poverty. This means tackling tax dodging but also increasing taxes on wealth and high incomes to ensure a more level playing field and generate the billions of dollars needed to invest in healthcare, education, and job creation.

Texas has no income tax, which is a big draw for corporate executives who do business there. But it's hardly tax-free. The property taxes are high for a Southern state. The sales taxes are high. One study found that the bottom 20 percent of the Texas population pays 12 percent of its income in state and local taxes.

Besides the devastating impact that the Ryan budget has directly on individuals, it does nothing to support job creation or our global competitiveness. Investments in both are drastically affected through cuts in funding for transportation and infrastructure projects, as well as funding for research and development.