A Quote by Michelle Singletary

You shouldn't invest the money if you are looking to use it within five years. Too much risk.

Related Quotes

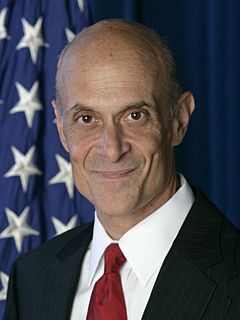

The money has to be deferred with what they call "clawback," which means they can get it back if I lose it all. So that guy making ten million a year selling credit default swaps, if we're going to keep five million of it in escrow for ten years, and with the right to go back and get it, if he starts losing money, then we're going to give people the right incentives not too take so much risk.

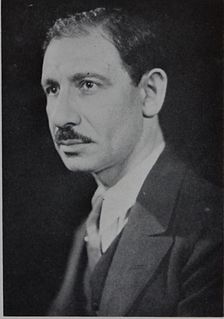

Don't be too much concerned about money, because that is the greatest distraction against happiness. And the irony of ironies is that people think they will be happy when they have money. Money has nothing to do with happiness. If you are happy and you have money, you can use it for happiness. If you are unhappy and you have money, you will use that money for more unhappiness. Because money is simply a neutral force.

The average American thinks billionaire investors are going to be right based on some talking head. They invest and they have no backup plan. Americans think these guys are giant risk-takers. The truth is they believe in taking as little risk as humanly possible, for the maximum amount of upside. They're looking for that spread of disproportionate risk-reward.

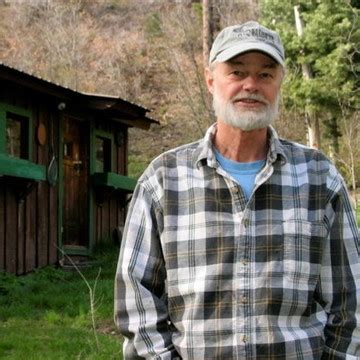

I used to be a lawyer and I quit the practice of law to start writing and one of the reasons that I did that was I had an older sister who was too sick, who had breast cancer and it just got me to this moment of really looking at my life and saying what do I really want to do? What is really going to make me happy? Do I want to be sixty-five years old looking back and regretting not ever having taken the chance or the risk?

If you invest and don't diversify, you're literally throwing out money. People don't realize that diversification is beneficial even if it reduces your return. Why? Because it reduces your risk even more. Therefore, if you diversify and then use margin to increase your leverage to a risk level equivalent to that of a nondiversified position, your return will probably be greater.

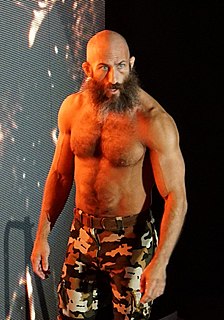

I'm a guy who likes to keep fighting five, six times a year, so if I ask for too much money, they might say, 'Well, we pay you too much. We can't let you keep jumping backwards and forwards and promote it.' The money I'm making is good to keep grabbing short-notice fights. I love them; they're my favorite ones.

I'm often asked how to start investing with little or no money. Please hear this as this is the hardest thing for people to understand: you do NOT invest with money! You invest with your mind! No matter what the field, your biggest asset is your mind. Once you have knowledge, you find deals, find your team and use other people’s money. You sell the deal and your team to get investment money.