A Quote by Michelle Singletary

The schools can't cover all the values that go along with how you handle your money. For example, a financial literacy class might not teach me to hate debt the way my grandmother, Big Mama did.

Related Quotes

God, teach me to be patient, teach me to go slow, Teach me how to wait on You when my way I do not know. Teach me sweet forbearance when things do not go right So I remain unruffled when others grow uptight. Teach me how to quiet my racing, rising heart So I might hear the answer You are trying to impart. Teach me to let go, dear God, and pray undisturbed until My heart is filled with inner peace and I learn to know your will.

We don't invest in financial literacy in a meaningful way. We should be teaching elementary school children how to balance a checkbook, how to do basic accounting, why it's important to pay your bills on time. First, education. Begin the learning process as early as possible, in elementary school. Second, encourage and support entrepreneurism. Third, policy. I know it's a priority of the US Treasury to augment financial inclusion and increase financial literacy.

I hate the way you talk to me, and the way you cut your hair. I hate the way you drive my car. I hate it when you stare. I hate your big dumb combat boots, and the way you read my mind. I hate you so much it makes me sick; it even makes me rhyme. I hate it, I hate the way you're always right. I hate it when you lie. I hate it when you make me laugh, even worse when you make me cry. I hate it when you're not around, and the fact that you didn't call. But mostly I hate the way I don't hate you. Not even close, not even a little bit, not even at all.

Financial literacy is not an end in itself, but a step-by-step process. It begins in childhood and continues throughout a person's life all the way to retirement. Instilling the financial-literacy message in children is especially important, because they will carry it for the rest of their lives. The results of the survey are very encouraging, and we want to do our part to make sure all children develop and strengthen their financial-literacy skills.

Sometimes having no script, having no idea what is going to happen next, having no map, might be the way to go. Because life just happens, and when it does, how you handle it will teach you more about who you are than any class or test ever can. The best preparation for the rest of your life is, maybe, no preparation at all. Dive right in. Make mistakes. Break a few rules. Wing it.

I have never understood the importance of having children memorize battle dates. It seems like such a waste of mental energy. Instead, we could teach them important subjects such as How the Mind Works, How to Handle Finances, How to Invest Money for Financial Security, How to be a Parent, How to Create Good Relationships, and How to Create and Maintain Self-Esteem and Self-Worth. Can you imagine what a whole generation of adults would be like if they had been taught these subjects in school along with their regular curriculum?

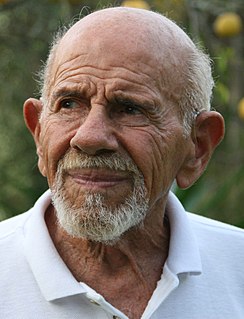

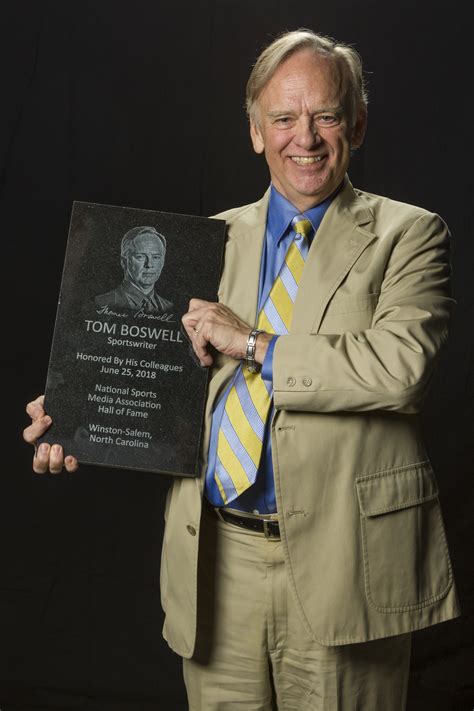

My grandmother's grandparents were slaves. My grandmother Big Mama would tell me about the stories she heard as a child growing up in the shadows of a North Carolina plantation. It's only been in my lifetime that blacks have had the right to vote, live in certain areas or hold certain jobs. It is with this black history that I write about the financial challenges African-Americans still have.

Everything that you've learned: 'Make a lot of money, have a nice house'. But they never teach you at school how to relate, how to communicate with others, how to share values with others. ...They teach you how to make a living. You become an optometrist, he becomes a physicist, she becomes a structural engineer, he's an architect. In the future, none of that. Everybody is trained to be a generalist, so they understand different cultures, different values, how we get to be the way we are. So no-one can ever use you for war or killing anybody or hurting anybody