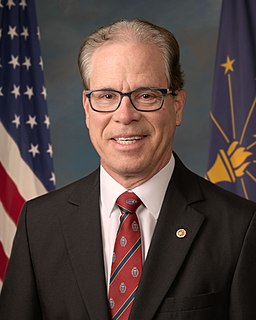

A Quote by Mike Braun

Student loan origination fees are nothing more than a hidden tax that burdens students.

Related Quotes

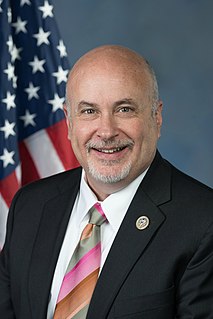

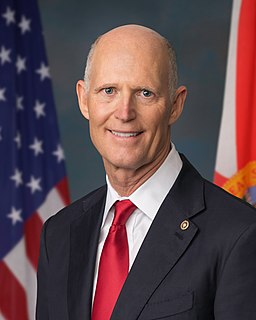

The fact that you have government-guaranteed student loans has created a whole new sector in the American economy that didn't really exist before - private for-profit universities that sell junk degrees that don't help the students. They promise the students, "We'll help you get a better job. We'll arrange a loan so that you don't have to pay a penny for this education." Their pet bank gets them the government-guaranteed loan, and the student may get the junk degree, but doesn't get a job, so they don't pay the loan.

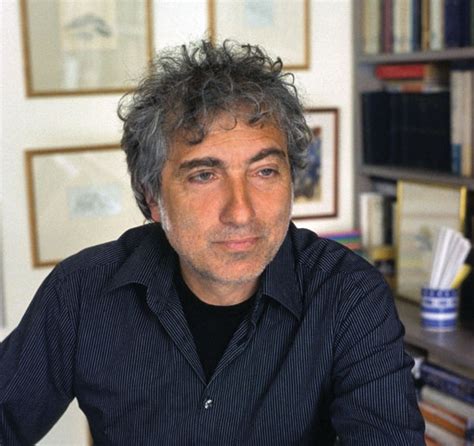

The loan crisis and the increasing slashing of funds for students, coupled with the astronomical rise in tuition, represent an unparalleled attack on the social state. The hidden agenda here is that when students graduate with such high debts, they rarely choose a career in public service; instead, they are forced to go into the corporate sector, and I see these conditions, in some ways, as being very calculated and as part of a larger political strategy to disempower students.