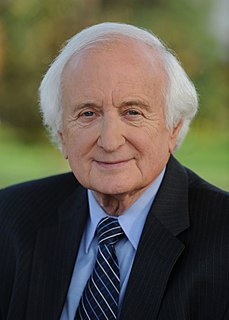

A Quote by Mike Huckabee

Things that have happened with Enron and companies like that, where they've squandered their employees' pension funds, I think it has brought a new level of anxiety. People don't feel like they can trust their employer.

Related Quotes

When the trust is high, you get the trust dividend. Investors invest in brands people trust. Consumers buy more from companies they trust, they spend more with companies they trust, they recommend companies they trust, and they give companies they trust the benefit of the doubt when things go wrong.

The only beef Enron employees have with top management is that management did not inform employees of the collapse in time to allow them to get in on the swindle. If Enron executives had shouted, "Head for the hills!" the employees might have had time to sucker other Americans into buying wildly over-inflated Enron stock. Just because your boss is a criminal doesn't make you a hero.

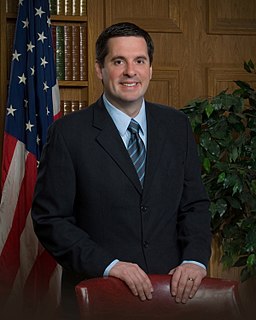

The not-quite-sort-of lie works here too - often an ad will announce that "Congressman Johnson voted for a bill that gave tax breaks to companies like Enron." True - although the bill allowed all companies to accelerate depreciation of copying machines. Yes, Enron benefited, but Enron also benefited from the revolution of the Earth around the sun. Hardly an argument to freeze the planet in one spot.

Modern Australian trade unionism and the unionist that I am doesn't rely on a class war view that somehow that the interests of employees and managers are in two separate spheres and they're irreconcilable. I believe that when people can go to work and be happy, satisfied, engaged, where the employer is getting employees who feel their interests are aligned with the employer, you get productivity. This is the future of Australian workplaces.

The CEO of Enron, Jeffrey Skilling, married one of the Enron secretaries this week. It's amazing how romantic these Enron guys can be when they realize that wives can't be forced to testify against their husbands. Skilling said today she was the best secretary Enron had ever had. She could shred 950 words a minute. ... I guess they are on their honeymoon right now. That's going pretty well. Hey, he's used to screwing Enron employees.

My first album deals with my anxiety. It wasn't like, to heal my anxiety and by writing an album I'm now healed. It was, here's a sound representation of what it feels like to be in an anxiety attack and that's it. I think we can say the same with image, people look at an image and see a billion different things.

Imagine if the pension funds and endowments that own much of the equity in our financial services companies demanded that those companies revisit the way mortgages were marketed to those without adequate skills to understand the products they were being sold. Management would have to change the way things were done.