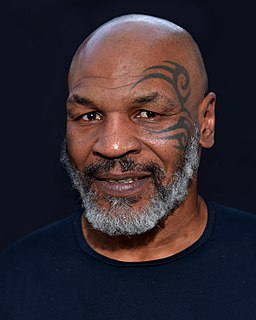

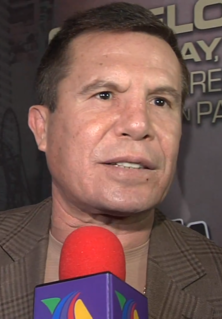

A Quote by Mike Tyson

Being a champion opens lots of doors—I'd like to get a real estate license, maybe sell insurance.

Related Quotes

The business side of real estate investing is fraught with risk. Unlike purchasing mutual funds or savings bonds, with real estate, you can lose money; this is one of the reasons that seasoned real estate investors caution neophytes never to get too emotional about a property and always be willing to walk away.

I arrived at my hut in Beverly Hills just in time to keep real estate men from plotting off and selling my front yard. They will sell you anything or anybody's in the world as long as they can get a first payment... It used to be only Iowa that was out here but now they have three or four adjoining states interested and they are here, too. Real estate agents - you never saw as many in your life; they are as thick as bootleggers.

So, what people are actually left with to spend is maybe 25 to 30% of their income on goods and services, after paying taxes and after paying the FIRE sector (Finance, Insurance, Real Estate). Whether it's housing insurance or mortgage insurance. So there's an idea of distracting people. Don't think of your condition. Think of how the overall economy is doing. But don't think of the economy as an overall unit. Think of the stock market as the economy. Think of the rich people as the economy. Look at the yachts that are made. Somebody's living a lot better. Couldn't it be you?

It's a wonderful profession, and it opens lots of doors, and I think it's quite right that people can accuse actors and actresses of being dilettante, but you learn on every job, whatever it is, the process moves you on in some way, and yeah, I want to expand my knowledge of our existence, I suppose.

Today the strategies of many companies in the real estate industry are premised on low interest rates, an assumption that has resulted in the rapid expansion of the real estate securitization business. This trend could be regarded as a risk factor, as it exposes the real estate sector to at least three potential problems: first, interest rate hikes; second, revisions to securitization business accounting standards; and third, overheating in the real estate market.