A Quote by Milton Friedman

Congress can raise taxes because it can persuade a sizable fraction of the populace that somebody else will pay

Related Quotes

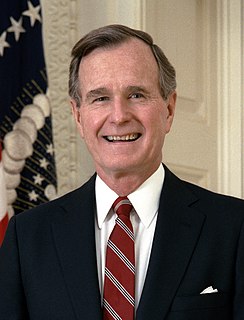

I'm the one who will not raise taxes. My opponent now says he'll raise them as a last resort, or a third resort. But when a politician talks like that, you know that's one resort he'll be checking into. My opponent, my opponent won't rule out raising taxes. But I will. And The Congress will push me to raise taxes and I'll say no. And they'll push, and I'll say no, and they'll push again, and I'll say, to them, Read my lips: no new taxes.

With a congressional mandate to run the deficit up as high as need be, there is no reason to raise taxes now and risk aggravating the depression. Instead, Obama will follow the opposite of the Reagan strategy. Reagan cut taxes and increased the deficit so that liberals could not increase spending. Obama will raise spending and increase the deficit so that conservatives cannot cut taxes. And, when the economy is restored, he will raise taxes with impunity, since the only people who will have to pay them would be rich Republicans.

The president doesn't get an automatic pay raise, so they can't freeze it for him. But it also does extend the pay rate - they pay increases or pay freeze for pay increases for members of Congress. They've had a pay freeze since 2009, but most civil servants will see a small pay bump in 2016 thanks to a separate order from President Obama.

When you pay social security taxes, you are in no way making provision for your own retirement. You are paying the pensions of those who are already retired. Once you understand this, you see that whether you will get the benefits you are counting on when you retire depends on whether Congress will levy enough taxes, borrow enough, or print enough money.

I thought you liberals cared about people, but here you're perfectly content to get them addicted to tobacco and make them pay taxes through the nose and continue to pay taxes through the nose and raise their taxes. And then you try to make 'em think you care about 'em by running PSAs telling them how they shouldn't smoke and how they should quit. You're exactly right. If they really cared, they would ban the product, but they can't, because the revenue from tobacco taxes - I'm not kidding you - funds children's health care programs, and a number of other things as well.

This is what class warfare looks like: The Business Roundtable - representing Goldman Sachs, Bank of America, JP Morgan Chase and others - has called on Congress to raise the eligibility age of Social Security and Medicare to 70, cut Social Security and veterans' COLAs, raise taxes on working families and cut taxes for the largest corporations in America.

We need a wealth tax that on a one-time basis is going to take back at least some small fraction of the great windfall that the upper 1 percent, or 5 percent and pay down the government debt, pay back the federal debt because we can't put this on the next generation or they're going to be buried paying taxes.