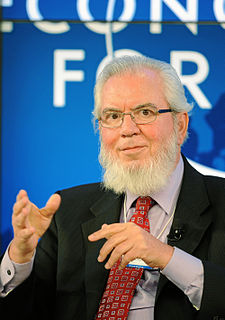

A Quote by Milton Friedman

If you continue to use monetary policy to attempt to promote full employment the result would be that you would have higher inflation, and that you would not have lower unemployment.

Related Quotes

The unique aspect of today's monetary inflation is that it is not limited to one country, but a host of countries are all inflating together. As a result of the monetary inflation (when all of the newly created money begins to leave the banks and enter the system), the price inflation will be worldwide.

Inflation is certainly low and stable and, measured in unemployment and labour-market slack, the economy has made a lot of progress. The pace of growth is disappointingly slow, mostly because productivity growth has been very slow, which is not really something amenable to monetary policy. It comes from changes in technology, changes in worker skills and a variety of other things, but not monetary policy, in particular.

You would think that if any group in America had 20% to 25% unemployment, it would generate all kinds of attention. The Labor Department would understandably and necessarily begin to concentrate on what can we do to reduce this level of unemployment. Congress would give great time on the floor for debate on what can be done.

Because tax cuts create an incentive to increase output, employment, and production, they also help balance the budget by reducing means-tested government expenditures. A faster-growing economy means lower unemployment and higher incomes, resulting in reduced unemployment benefits and other social welfare programs.

I think the team that successfully puts together an economic and social policy framework for global full employment in decent working conditions based on local development, that would command the support of all stakeholders and all international organizations concerned, should be awarded the [Nobel] prize. I am sure they would get it not just for economics, but also for peace in the world.

The basic prescription for preventing deflation is therefore straightforward, at least in principle: Use monetary and fiscal policy as needed to support aggregate spending, in a manner as nearly consistent as possible with full utilization of economic resources and low and stable inflation. In other words, the best way to get out of trouble is not to get into it in the first place.