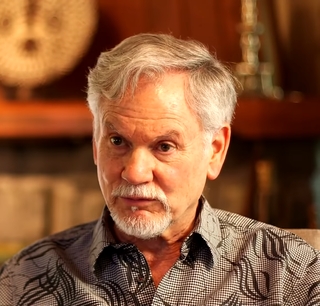

A Quote by Milton Friedman

We have a system that increasingly taxes work and subsidizes nonwork.

Quote Topics

Related Quotes

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.

For the system of government you fashioned including the very principles on which you based it, is increasingly obsolete, and hence increasingly, if inadvertently, oppressive and dangerous to our welfare. It must be radically changed and a new system of government invented, a democracy for the 21st century. For this wisdom, above all, I thank Mr. Jefferson who helped create the system that served us so well for so long, and that now must, in its turn, die and be replaced.

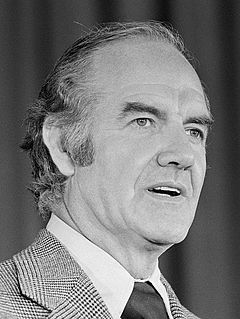

And above all, above all, honest work must be rewarded by a fair and just tax system. The tax system today does not reward hard work: it penalizes it. Inherited or invested wealth frequently multiplies itself while paying no taxes at all. But wages on the assembly line or in farming the land, these hard-earned dollars are taxed to the very last penny.

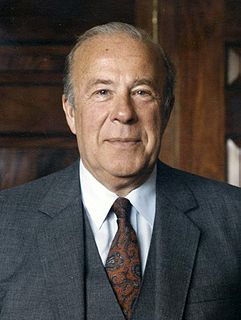

The British use a system where the profits a corporation reports to shareholders is what they pay taxes on. Whereas in America we require corporations to keep two sets of books, one for shareholders and one for the IRS, and the IRS records are secret. For publicly-traded companies, the British system would tend to align the interests of the government with the interests of the company because the company wants to report the biggest possible profit. Though, all wealthy countries have high taxes as wealth requires lots of common goods, from clean water to public education to a justice system.

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.