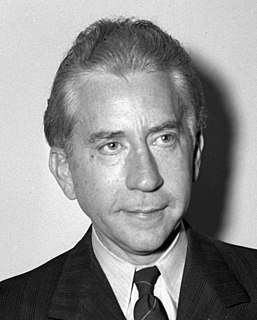

A Quote by Mitch Daniels

So tonight I propose one more step that I would rather not propose. I ask the most fortunate among us, those citizens earning over $100,000 per year, for one year, to pay an additional one percent on the income they receive.

Related Quotes

For the three decades after WWII, incomes grew at about 3 percent a year for people up and down the income ladder, but since then most income growth has occurred among the top quintile. And among that group, most of the income growth has occurred among the top 5 percent. The pattern repeats itself all the way up. Most of the growth among the top 5 percent has been among the top 1 percent, and most of the growth among that group has been among the top one-tenth of one percent.

We economists, in our classes, teach students that to some degree, price discrimination is actually a good thing; that it allows you to serve lower-income people. Take Africa, with AIDS. They could never finance what an AIDS cocktail costs here, over $10,000 a year. But if you sold it to them for $300 a year, which just barely covers cost, they could probably serve quite a few of their citizens, with World Bank help. We economists say that will be beneficial. But it's a two-tier system; yes, African people pay less than we would pay.

Where taxes are concerned, there are two clear-cut points of view. There are those who think they're too high and those who think they should be even higher because, after all, politicians spend our money far more wisely than we do. The obvious solution I'd propose is that the people in the first group would pay less and those in the second group would pay more. Lots more.

Remember, there are no cuts to Medicaid. Every year in Medicaid, you spend more money than you spent the year before under this plan, but the growth is not as great as it would be if you continued to pay, for instance, 100 percent for single able-bodied adults. Now, there is something wrong with the way that system is put together.

If top marginal income tax rates are set too high, they discourage productive economic activity. In the limit, a top marginal income tax rate of 100 percent would mean that taxpayers would gain nothing from working harder or investing more. In contrast, a higher top marginal rate on consumption would actually encourage savings and investment. A top marginal consumption tax rate of 100 percent would simply mean that if a wealthy family spent an extra dollar, it would also owe an additional dollar of tax.

If the US Government was a family—they would be making $58,000 a year, spending $75,000 a year, & are $327,000 in credit card debt. They are currently proposing BIG spending cuts to reduce their spending to $72,000 a year. These are the actual proportions of the federal budget & debt, reduced to a level that we can understand.

If you're going to buy something which compounds for 30 years at 15% per annum and you pay one 35% tax at the very end, the way that works out is that after taxes, you keep 13.3% per annum. In contrast, if you bought the same investment, but had to pay taxes every year of 35% out of the 15% that you earned, then your return would be 15% minus 35% of 15%-or only 9.75% per year compounded. So the difference there is over 3.5%. And what 3.5% does to the numbers over long holding periods like 30 years is truly eye-opening.

If you can propose a memoir, even if you are eighteen years old - and what do you remember? What are you memeing? If you can propose a memoir, I believe someone will pay you to write it. And you will get a contract for nonfiction. And if it is about victimology in one way or another than you'll get more money. It's a sensation.