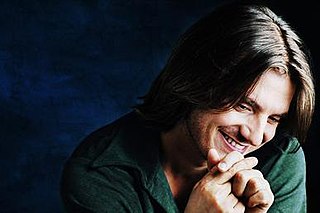

A Quote by Mitch Hedberg

I like it when you buy something and pay with a credit card, they put your credit card on the receipt, but only the last four numbers. Aha! I'm really good at guessing twelve numbers. I can't guess 16 numbers, so thanks for the assistance!

Related Quotes

If you have credit card debt and credit card companies continue to close down the cards, what are you going to do? What are you going to do if they raise your interest rates to 32 percent? That's five times higher than what your kid is going to pay in interest on a student loan. Get rid of your credit card debt.

I have no credit cards. That was the decision that was made jointly by the credit card companies, and by me. I can't say that that was completely on my account. I buy nothing on credit now, nothing. If I can't afford it, I don't buy it. I have a debit card, that's all I have. Any debt that I have, I am paying down.

I really like even numbers, and I like heavily divisible numbers. Twelve is my lucky number - I just love how divisible it is. I don't like odd numbers, and I really don't like primes. When I turned 37, I put on a strong face, but I was not looking forward to 37. But 37 turned out to be a pretty amazing year.

Maybe you'll take the cash out. So a credit card company or a bank that goes into the business of saying we're going to be the broker, we're going to sell you a mortgage that you're going to be able to pay off, we're going to help you reduce your credit card debt, we're going to help you save for retirement, we're going to put you into mutual funds that have low fees rather than high fees.