A Quote by Mitt Romney

It was absolutely critical to renew the Bush tax cuts. Letting them expire would result in a massive tax increase that would retard economic growth.

Related Quotes

Obama and the Democrats' preposterous argument is that we are just one more big tax increase away from solving our economic problems. The inescapable conclusion, however, is that the primary driver of the short-term deficit is not tax cuts but the lack of any meaningful economic growth over the last half decade.

Democrats in Washington predicted that tax cuts would not create jobs, would not increase wages, and would cause the federal deficit to explode. Well, the facts are in. The tax cuts have led to a strong economy. Real wages were on the rise, and deficit has been cut in half three years ahead of schedule.

All those predictions about how much economic growth will be created by this, all of those new jobs, would be created by the things we wanted - the extension of unemployment insurance and middle class tax cuts. An estate tax for millionaires adds exactly zero jobs. A tax cut for billionaires - virtually none.

In December, I agreed to extend the tax cuts for the wealthiest Americans because it was the only way I could prevent a tax hike on middle-class Americans. But we cannot afford $1 trillion worth of tax cuts for every millionaire and billionaire in our society. We can't afford it. And I refuse to renew them again.

Any Democrat who squirms on the tax-cut issue in the primaries has no chance ' zero ' to win the nomination. Each will have to take the “pledge” to oppose the Bush tax cuts. Thus, Bush will have succeeded in creating a situation where anyone who can win the nomination can't win the election. Democrats are not about to nominate anyone who backs the tax cut, and Americans are not going to elect anyone who favors a tax increase.

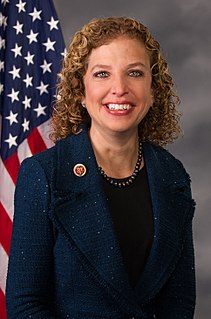

We certainly could have voted on making the middle-class tax cuts and tax cuts for working families permanent had the Republicans not insisted that the only way they would support those tax breaks is if we also added $700 billion to the deficit to give tax breaks to the wealthiest 2 percent of Americans. That's what was really disturbing.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

People in my hometown voted for President Reagan - for many, like my grandpa, he was their first Republican - because he promised that tax cuts would bring higher wages and new jobs. It seemed he was right, so we voted for the next Republican promising tax cuts and job creation, George W. Bush. He wasn't right.