A Quote by Mitt Romney

Let me tell you, the heart of my tax proposal: I will not raise taxes on the American people. I will not raise taxes on middle-income Americans.

Related Quotes

I'm not going to tell people that I will raise your incomes and not your taxes, and not mean it, because I don't want to see the kind of struggle that the middle class is going through exemplified by these promises that would raise taxes and make it much more difficult for many, many Americans to get ahead and stay ahead. That is not my agenda.

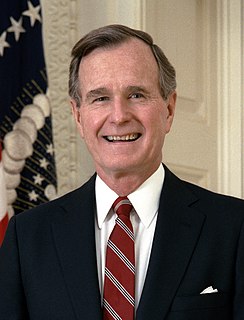

I'm the one who will not raise taxes. My opponent now says he'll raise them as a last resort, or a third resort. But when a politician talks like that, you know that's one resort he'll be checking into. My opponent, my opponent won't rule out raising taxes. But I will. And The Congress will push me to raise taxes and I'll say no. And they'll push, and I'll say no, and they'll push again, and I'll say, to them, Read my lips: no new taxes.

With a congressional mandate to run the deficit up as high as need be, there is no reason to raise taxes now and risk aggravating the depression. Instead, Obama will follow the opposite of the Reagan strategy. Reagan cut taxes and increased the deficit so that liberals could not increase spending. Obama will raise spending and increase the deficit so that conservatives cannot cut taxes. And, when the economy is restored, he will raise taxes with impunity, since the only people who will have to pay them would be rich Republicans.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

In the name of short-term stimulus, he [Obama] will give every American family (who makes less than $200,000) a welfare check of $1,000 euphemistically called a refundable tax credit. And he will so sharply cut taxes on the middle class and the poor that the number of Americans who pay no federal income tax will rise from the current one-third of all households to more than half. In the process, he will create a permanent electoral majority that does not pay taxes, but counts on ever-expanding welfare checks from the government.

Arthur Laffer's idea, that lowering taxes could increase revenues, was logically correct. If tax rates are high enough, then people will go to such lengths to avoid them that cutting taxes can increase revenues. What he was wrong about was in thinking that income tax rates were already so high in the 1970s that cutting them would raise revenues.

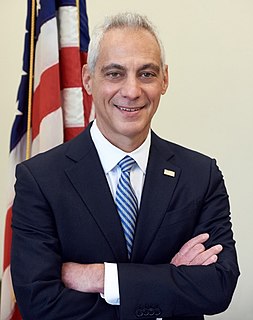

'Obama and Biden want to raise taxes by a trillion dollars.' Guess what? Yes, we do in one regard: We want to let that trillion dollar tax cut expire so the middle class doesn't have to bear the burden of all that money going to the super-wealthy. That's not a tax raise. That's called fairness where I come from.