A Quote by Mohamed El-Erian

We normally think if you're going to lend someone money, you should get some reward for doing this. In Europe, it's a tax!

Related Quotes

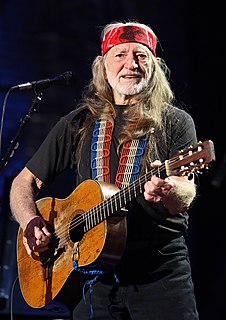

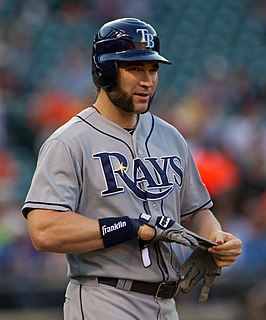

If I get married I get a tax break, if I have a kid I get a tax break, if I get a mortgage I get a tax break. I don't have any kids and I drive a hybrid, I think I should get a tax break. I'm trying to pay off my apartment so I have something tangible. I actually figured out if I paid off my place my reward would be that I would pay an extra four grand a year in taxes.

I think we should have basically the same tax policy that Germany, Japan, the U.K., everybody else has, which is a tax rate in the mid-20s and no loopholes. Zero. The U.S. has the most antiquated tax system. And that means some people are going to pay more taxes, and some people are going to pay less.

There's a lot of money in selling marijuana. If you can do it legally, that's good. Why should all the criminals make the money? This is what people are thinking. If it's happening, if it's going to be legal, let's tax it and regulate it, like we do with everything else and make some money off this. I think that's one reason why people are talking this a little more seriously.

We're going to bring a lot of money in on trade. We're going to bring a lot of money on reciprocal. You know, as an example, when you have countries with a big tax and we get nothing for the same product and we're paying - our companies are paying 100 percent tax in some countries and if they send their product to us we pay nothing. Doesn't make sense.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

I think that Democrats have to think through answers we haven't in the past: How we are going to create those jobs? How should we restructure the entire tax code? Should we have things like a payroll tax, when jobs are so scarce? They weren't - basically the architecture of our employment law, tax law, all these things were from the 1930s - and I do think that one benefit of Donald Trump, which is not worth it, but one perverse thing is, he has widened the scope of things that we should discuss.

I want to end tax dumping. States that have a common currency should not be engaged in tax competition. We need a minimum tax rate and a European finance minister, who would be responsible for closing the tax loopholes and getting rid of the tax havens inside and outside the EU. It is also clear that we have to reach common standards in our economic and labor policies. We cannot continue to just talk about technical details. We have to inspire enthusiasm in Germany for Europe.

What do the 5%, or the 1% actually use their money for? They lend it back to the economy at large, they load it down with debt. They make their money by lending to the bottom 95%, or the bottom 99%. When you give them more after-tax income, it enables them to buy even more control of government, even more control of election campaigns. They're not going to spend this money back into the goods-and-services economy.