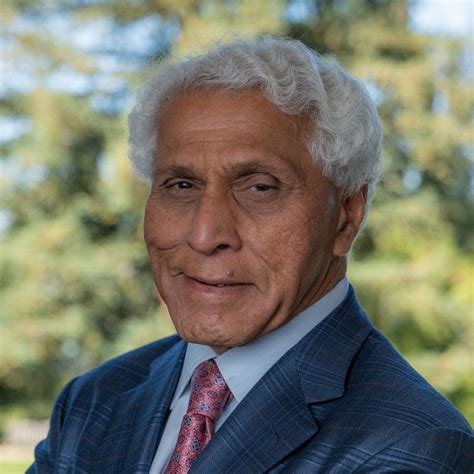

A Quote by Mohammad Hamid Ansari

Most of India's 300 odd news channels are making losses and are dependent on dubious cross holding, black money and dodgy private equity investors, both foreign and Indian.

Related Quotes

State funds, private equity, venture capital, and institutional lending all have their role in the lifecycle of a high tech startup, but angel capital is crucial for first-time entrepreneurs. Angel investors provide more than just cash; they bring years of expertise as both founders of businesses and as seasoned investors.

Indian higher education is completely regulated. It's very difficult to start a private university. It's very difficult for a foreign university to come to India. As a result of that, our higher education is simply not keeping pace with India's demands. That is leading to a lot of problems which we need to address.