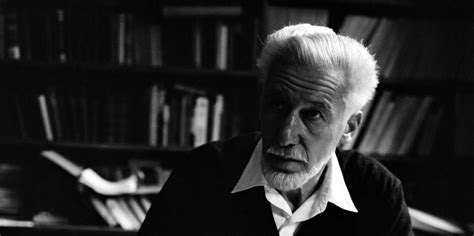

A Quote by Murray Rothbard

Monetary expansion is a massive scheme of hidden redistribution.

Related Quotes

The underconsumptionist of 1819 believed that consumption would be stimulated by tariffs, while the underconsumptionist of a later day urged monetary expansion as the remedy. On the other hand, the remedy proposed for the shortage of money capital was monetary inflation in 1819, encouragement of savings and thrift in the 1930s.

In the North, neither greenbacks, taxes, nor war bonds were enough to finance the war. So a national banking system was created to convert government bonds into fiat money, and the people lost over half of their monetary assets to the hidden tax of inflation. In the South, printing presses accomplished the same effect, and the monetary loss was total.

The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. Deficit spending is simply a scheme for the hidden confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard.

We conclude that the concentration of wealth is natural and inevitable, and is periodically alleviated by violent or peaceable partial redistribution. In this view all economic history is the slow heartbeat of the social organism, a vast systole and diastole of concentrating wealth and compulsive redistribution.