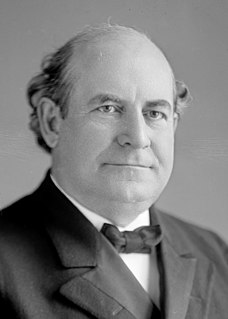

A Quote by Murray Rothbard

Commercial banks - that is, fractional reserve banks - create money out of thin air. Essentially, they do it in the same way as counterfeiters.

Quote Topics

Related Quotes

At the base of the Fed pyramid, and therefore of the bank system's creation of "money" in the sense of deposits, is the Fed's power to print legal tender money. But the Fed tries its best not to print cash but rather to "print" or create demand deposits, checking deposits, out of thin air, since its demand deposits constitute the reserves on top of which the commercial banks can pyramid a multiple creation of bank deposits, or "checkbook money."

First reason is, it's not authorized in the Constitution, it's an illegal institution. The second reason, it's an immoral institution, because we have delivered to a secretive body the privilege of creating money out of thin air; if you or I did it, we'd be called counterfeiters, so why have we legalized counterfeiting? But the economic reasons are overwhelming: the Federal Reserve is the creature that destroys value.

You know policy is driven purely in self interest. The Federal Reserve Bank and the commercial banks and the Wall Street banks are not acting in the interests of the population at large, they're acting purely in their own self-interest, which is a shame because they're actions dictate the reality for 300 million Americans. But they don't see it that way, they see it only as a way to preserve their own self-interest.

If all the bank loans were paid, no one could have a bank deposit, and there would not be a dollar of coin or currency in circulation. This is a staggering thought. We are completely dependent on the commercial banks. Someone has to borrow every dollar we have in circulation, cash, or credit. If the banks create ample synthetic money we are prosperous; if not, we starve. We are absolutely without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity of our hopeless situation is almost incredible - but there it is.

In our election manifesto is: we keep the right to create money and to bring in circulation, for the cause of the government ... Those who do not share this view, reply us to the issue of paper money is for the banks, the government should stay out of the banking business. I agree with Jefferson's opinion ... and just like him I say again: the issue of money is a matter for the government and the banks should stay out of government activity.

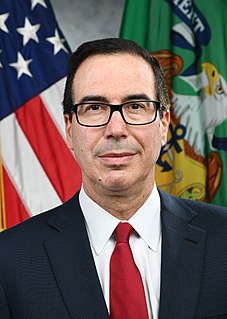

I passionately disagreed with Treasury Secretary Hank Paulson's plan to bail out the banks by using a public fund called the Troubled Asset Relief Program (TARP) to help banks take toxic assets off their balance sheets. I argued that it would be much better to put the money where the hole was and replenish the equity of the banks themselves.