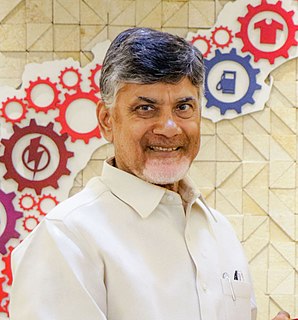

A Quote by N. Chandrababu Naidu

People are losing faith in the banking system due to security issues.

Quote Topics

Related Quotes

Italy spills over to everything. Italy is a huge banking system. It has been the major banking system in Eastern Europe. It's worked with Austria's banking system. There's all sorts of interplays there. So it's not the PIIGS one should worry about. Germany hasn't even begun falling yet. And when Germany falls, and it will, that's when the panic begins to set in.

Repeal the entire Banking Act of 1933, and Austrian School economists will cheer, especially if the current system were replaced by a 100%-reserve competitive banking with no central bank. That banking reform would give us a sound money system, meaning no more business cycle, bailouts, or inflation.

I've got to say our banking system is a safe and a sound one. And since the days when we've had federal deposit insurance in place, we haven't had a depositor who's got less than $100,000 in an account lose a penny. So the American people can be very, very confident about their accounts in our banking system.