A Quote by Nancy Pelosi

What the Republicans have said is rather than touch one hair on the heads of the wealthiest people in our country, people who make over $1 million a year, they're saying, 'Seniors should pay $6,000 more dollars a year. But please don't let us ask the wealthiest to do their fair share.'

Related Quotes

I want to reform the tax code so that it's simple, fair, and asks the wealthiest households to pay higher taxes on incomes over $250,000 - the same rate we had when Bill Clinton was president; the same rate we had when our economy created nearly 23 million new jobs, the biggest surplus in history, and a lot of millionaires to boot.

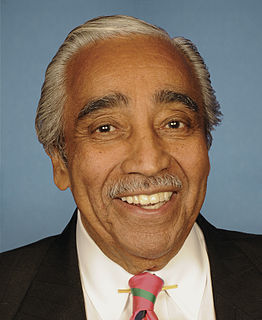

The rich people are apparently leaving America. They're giving up their citizenship. These great lovers of America who made their money in this country-when you ask them to pay their fair share of taxes they run abroad. We have 19-year old kids who lost their lives in Iraq and Afghanistan defending this country. They went abroad. Not to escape taxes. They're working class kids who died in wars and now billionaires want to run abroad to avoid paying their fair share of taxes. What patriotism! What love of country!

Malaria is a disease that kills one to three million people a year. 300 to 500 million cases are reported. It's estimated that Africa loses about 13 billion dollars a year to the disease. Five dollars can save a life. We can send people to the moon; we can see if there's life on Mars - why can't we get five-dollar nets to 500 million people?