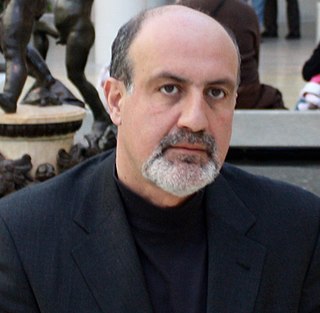

A Quote by Nassim Nicholas Taleb

Private equity has absolutely no reason to exist. The private equity holder has all the upside and the banks all the downside.

Related Quotes

If you have money draining out of the public equity markets, that inevitably affects the private equity market. They cannot exist going in different directions because somehow that will rent the fabric of the universe. It's just not permitted that that happens. Obviously there can be anomalies for brief periods of time but it just can't happen forever.

Nobody in my generation ever started out in private equity. We got there by accident. There was no private equity business - actually, the word didn't even exist - when I started. I got there out of the purest of happenstance and so I think many people find what they really enjoy doing just in that way. So another piece of advice for you is: don't worry too much about what you're going to be doing when you get out of business school - life will come your way.

Being a good private equity investor is more complicated than it seems. I would say that there are a few characteristics that are important. If you look at the skill set that you need to ultimately be a successful private equity investor, at least at the senior level, you have to be, in this business, a good investor. You have to be able to help companies perform and you have to have judgment around exiting investments. If you look at the skill sets there, they include some things you can teach and some that you can't.

Banks don't want certain asset classes, and that's created opportunities for private equity, hedge funds, Silicon Valley. In this case I think he was referring to some of the European banks shedding assets, and the big buyers are probably not going to be big American banks. Someone like Blackstone may have a very good chance to buy those assets, leverage them, borrow up a little bit, and do something good there.

We [US government] have used our taxpayer dollars not only to subsidize these banks but also to subsidize the creditors of those banks and the equity holders in those banks. We could have talked about forcing those investors to take some serious hits on their risky dealings. The idea that taxpayer dollars go in first rather than last - after the equity has been used up - is shocking.

In a world of businessmen and financial intermediaries who aggressively seek profit, innovators will always outpace regulators; the authorities cannot prevent changes in the structure of portfolios from occurring. What they can do is keep the asset-equity ratio of banks within bounds by setting equity-absorption ratios for various types of assets. If the authorities constrain banks and are aware of the activities of fringe banks and other financial institutions, they are in a better position to attenuate the disruptive expansionary tendencies of our economy.