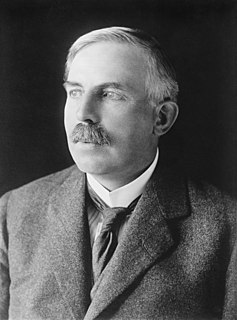

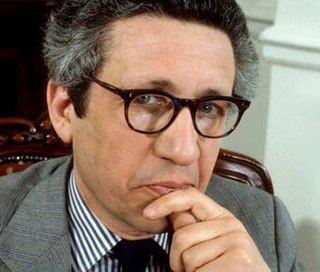

A Quote by Nassim Nicholas Taleb

Debt is a mistake between lender and borrower, and both should suffer.

Related Quotes

Hudson Taylor and Charles Spurgeon believed that Romans prohibits debt altogether. However, if going into debt is always sin, it's difficult to understand why Scripture gives guidelines about lending and even encourages lending under certain circumstances. Proverbs says "the borrower is servant to the lender." It doesn't absolutely forbid debt, but it's certainly a strong warning.

Debt settlement companies work as a middleman between you and your creditor. If all goes well (and that's a big if), you should be able to settle your debts for cents on the dollar. You'll also pay a fee to the debt settlement company, usually either a percentage of the total debt you have or a percentage of the total amount forgiven.