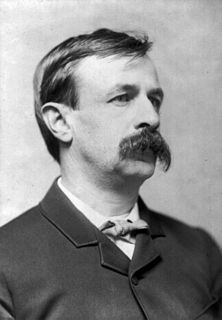

A Quote by Nathan Rothschild, 1st Baron Rothschild

Fortunes are made by buying low and selling too soon.

Related Quotes

People nowadays interchange gifts and favors out of friendship, but buying and selling is considered absolutely inconsistent with the mutual benevolence which should prevail between citizens and the sense of community of interest which supports our social system. According to our ideas, buying and selling is essentially anti-social in all its tendencies. It is an education in self-seeking at the expense of others, and no society whose citizens are trained in such a school can possibly rise above a very low grade of civilization

With a profession such as investing, people see the 'doing' as the buying and selling. It is difficult to come home from work, and answer your spouse's question, 'what did you do today?' with 'well, I read a lot, and I talked a little.' If you're not buying or selling, you may feel you aren't doing anything.

We make too much out of past performance, and it's very misleading to investors. It causes them to move money around. They buy a fund that's hot and then it turns cold as all hot funds eventually do. And then they get out. Well, buying at the high and selling at the low isn't going to leave you a satisfied shareholder, right?

There's only one thing that all of the central banks control and that is the base, their own liability, and they can control that in various ways. They can control it directly by open market operations, buying and selling government securities or other assets, for example, buying and selling gold, or they can control it indirectly by altering the rate at which banks lend to one another.