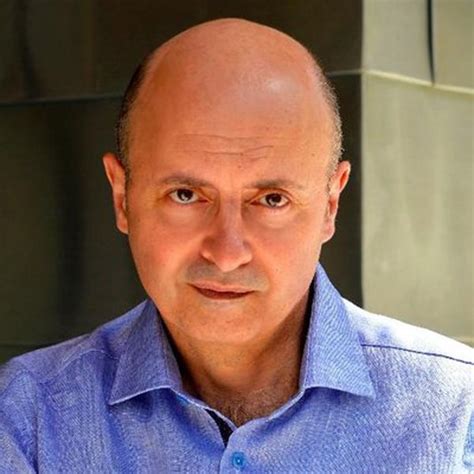

A Quote by Naval Ravikant

If you're investing in a company in the Bitcoin economy, you have to compare the valuation of the company to the valuation of the entire economy.

Related Quotes

Valuations are always much-debated. I try to center on what is the value to us. Is it solving a problems for us? If it is, we find a way to proceed. If the valuation has been overhyped on something and it doesn't make sense, we won't. It's very simple for me. I tend not to worry too much about the valuation. It's really what the value is to us.