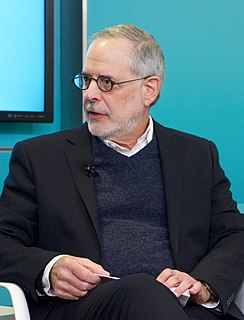

A Quote by Ned Lamont

We cannot put Connecticut's future on the credit card. The state has had a problem putting costs on Connecticut's credit card that it simply can't afford to pay.

Related Quotes

I have no credit cards. That was the decision that was made jointly by the credit card companies, and by me. I can't say that that was completely on my account. I buy nothing on credit now, nothing. If I can't afford it, I don't buy it. I have a debit card, that's all I have. Any debt that I have, I am paying down.

If you have credit card debt and credit card companies continue to close down the cards, what are you going to do? What are you going to do if they raise your interest rates to 32 percent? That's five times higher than what your kid is going to pay in interest on a student loan. Get rid of your credit card debt.

Maybe you'll take the cash out. So a credit card company or a bank that goes into the business of saying we're going to be the broker, we're going to sell you a mortgage that you're going to be able to pay off, we're going to help you reduce your credit card debt, we're going to help you save for retirement, we're going to put you into mutual funds that have low fees rather than high fees.