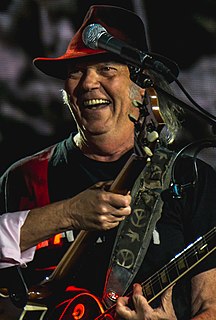

A Quote by Neil Young

It was then I knew I'd had enough, Burned my credit card for fuel Headed out to where the pavement turns to sand With a one-way ticket to the land of truth And my suitcase in my hand

Related Quotes

In about one-third of credit card consolidations, within a short period of time, the cards come back out of the wallet, and in no time at all, they're charged back up. Then you're in an even worse position, because you have the credit card debt and the consolidation loan to worry about. You're in a hole that's twice as deep - and twice as steep.

I've had something sort of like angel cards where you pull out an angel card that turns out, like, grandmother was watching over me. And I believe, in some way, I haven't been brave enough to engage with tarot cards mostly because they always end on a bad note. I'm sure if I understood tarot cards more I wouldn't be as fearful.

If you have credit card debt and credit card companies continue to close down the cards, what are you going to do? What are you going to do if they raise your interest rates to 32 percent? That's five times higher than what your kid is going to pay in interest on a student loan. Get rid of your credit card debt.