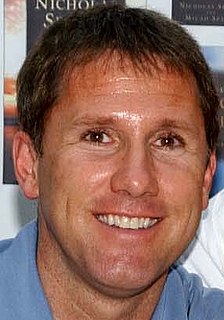

A Quote by Nicholas Sparks

Related Quotes

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.

In the stock market (as in much of life), the beginning of wisdom is admitting your ignorance. One of the many things you cannot know about stocks is exactly when they will up or go down. Over the long term, stocks generally rise at a nice pace. History shows they double in value every seven years or so. But in the short term, stocks are just plain wild. Over periods of days, weeks and months, no one has any idea what they will do. Still, nearly all investors think they are smart enough to divine such short-term movements. This hubris frequently gets them into trouble.

Any strategy that involves crossing a valley accepting short-term losses to reach a higher hill in the distance will soon be brought to a halt by the demands of a system that celebrates short-term gains and tolerates stagnation, but condemns anything else as failure. In short, a world where big stuff can never get done.

Frequent comparative ranking can only reinforce a short-term investment perspective. It is understandably difficult to maintain a long-term view when, faced with the penalties for poor short-term performance, the long-term view may well be from the unemployment line ... Relative-performance-oriented investors really act as speculators. Rather than making sensible judgments about the attractiveness of specific stocks and bonds, they try to guess what others are going to do and then do it first.