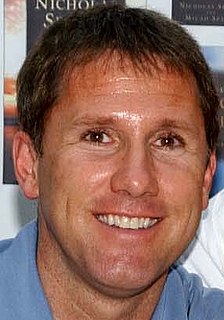

A Quote by Nick Harkaway

The market, as we're all painfully aware in the aftermath of the banking crisis, can be an idiot. It has no perception of right or wrong, or even sensible or insane. It sees profit.

Related Quotes

Even if you tell yourself "Today I'm going to drink coffee the wrong way ... from a dirty boot." Even that would be right, because you chose to drink coffee from that boot. Because you can do nothing wrong. You are always right. Even when you say, "I'm such an idiot, I'm so wrong..." you're right. You're right about being wrong. You're right even when you're an idiot. No matter how stupid your idea, you're doomed to be right because it's yours.

So perhaps the most worrying single remark made by a responsible banking official during the current crisis came from Jochen Sanio, the head of Germany's banking regulator BaFin. He warned on Aug. 1 that his country could be facing the worst banking crisis since 1931 - a reference to the collapse of Austria's Kredit Anstalt, which provoked a wave of bank failures across Europe.

The investor is neither smart not richer when he buys in an advancing market and the market continues to rise. That is true even when he cashes in a goodly profit, unless either (a) he is definitely through with buying stocks an unlikely story or (b) he is determined to reinvest only at considerably lower levels. In a continuous program no market profit is fully realized until the later reinvestment has actually taken place, and the true measure of the trading profit is the difference between the previous selling level and the new buying level.

Barack Obama is telling the banking industry what it can and can't charge and what profit he will accept and what level of profit he won't accept. Bill Clinton and Jimmy Carter came up with this scheme that resulted in the subprime mortgage crisis. They said it was unfair that poor and minority people didn't have houses, so we're basically gonna give 'em houses. How are we gonna do that? We're going to make the banks loan them money, knowing full well they can't pay it back.

When everybody else is in a down market is focusing on what they're doing wrong, instead focus on what you should be doing differently, it may be that what you did in the past was perfectly right. It is possible to do all the right things in business and still have a business crisis because of what's happening in the external environment. And if you start focusing on mistakes only, you're going to miss opportunities.