A Quote by Nicky Morgan

As chair of the Treasury Select Committee I hear time and time again just how important E.U. citizens are to the financial services sector. It is also apparent just how critical they are for our NHS too.

Related Quotes

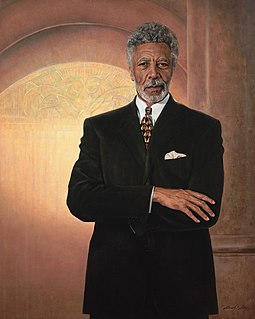

Being a mayor was an awesome, difficult job. Being the chair of the Armed Services Committee was perhaps the most incredible time in my life, because I got up one morning, and the peacenik from Berkeley was chair of the Armed Services Committee, and it was the greatest - one of the great challenges of my life.

We don't invest in financial literacy in a meaningful way. We should be teaching elementary school children how to balance a checkbook, how to do basic accounting, why it's important to pay your bills on time. First, education. Begin the learning process as early as possible, in elementary school. Second, encourage and support entrepreneurism. Third, policy. I know it's a priority of the US Treasury to augment financial inclusion and increase financial literacy.

That's the problem with the financial sector. Banks and the financial sector live in the short run, not the long run. In principle the government is supposed to make regulations that help the economy over time. But once it's taken over by the financial sector, the government lives in the short run too.

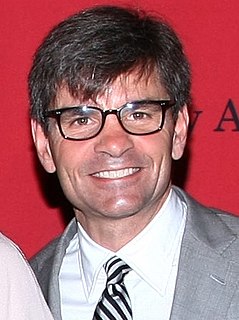

There's a statement from several members of the Senate, both Democrats and Republicans, including the Democratic leader, Charles Schumer; John McCain, the chair of the Senate Armed Services Committee; and Lindsey Graham, also a member of the Senate Armed Services Committee. They write that recent reports of Russian interference in our elections should alarm every American. They say Democrats and Republicans must work together to investigate this.

When large companies take on risk, then they impose risks on the rest of the system. And these are systemic risks and these systemic risks we never used to think were really that important, but as soon as we recognize how the financial sector - the risks the financial sector takes on can impact the entire global economy, we realize that those risks needed to be controlled for the social good.

If I've learnt anything over the last six years it's that the most important thing is the strength of our economy. That is how we pay for our NHS, how we build schools, how we provide opportunities for people. And I'm in absolutely no doubt that our economy will be stronger if we stay in and will be weaker and at risk if we leave.

The Fed contributed to the financial crisis, keeping interest rates too low for too long. I give them credit for responding and stabilizing the economy and the financial sector during the crisis. But then they tried to do too much with quantitative easing that went on forever, just dramatically exploding their balance sheets.