A Quote by Nicolas Sarkozy

We need to profoundly revise all of our taxes and charges. The aim is to tax pollution - notably fossil fuels - more, and tax work less

Related Quotes

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

The Value-Added Tax, a sales tax that applies at every level of business transactions, is an easy tax for governments to collect, and a hard tax to evade. So it makes the job of raising revenue easier. The revenues from the VAT can then be used to lower taxes on income and saving and investment. The Value-Added tax doesn't penalize work or saving; it's a tax on buying stuff.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

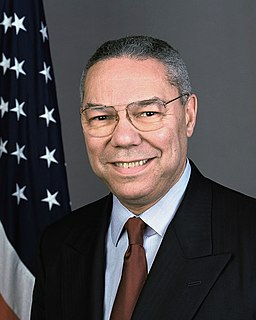

You are smart people. You know that the tax cuts have not fueled record revenues. You know what it takes to establish causality. You know that the first order effect of cutting taxes is to lower tax revenues. We all agree that the ultimate reduction in tax revenues can be less than this first order effect, because lower tax rates encourage greater economic activity and thus expand the tax base. No thoughtful person believes that this possible offset more than compensated for the first effect for these tax cuts. Not a single one.

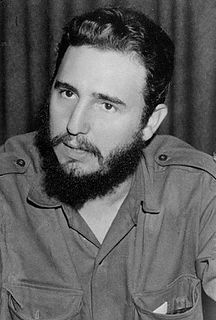

Every candidate running for president has got to answer the following very simple question: At a time when we need to address the planetary crisis of climate change, and transform our energy system away from fossil fuels and into energy efficiency and sustainability, should we continue to give $135 billion in tax breaks and subsidies over the next decade to fossil fuel companies?

I think we should have basically the same tax policy that Germany, Japan, the U.K., everybody else has, which is a tax rate in the mid-20s and no loopholes. Zero. The U.S. has the most antiquated tax system. And that means some people are going to pay more taxes, and some people are going to pay less.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

Tax rates aren't everything with regard to incentives to work. I would probably work at a 100% tax rate next to a nude modeling studio. I'm joking, but you know what I'm saying. There's a lot more to it than just tax rates. It's economics that I do; I don't do nude modeling studio economics. People do respond to taxes.