A Quote by Nikki Giovanni

Violence is like money in the bank; it's only helpful if you don't have to use it.

Related Quotes

For me, money is to use - it's only to use. So I never have money because I always spend. That's why in a way I protect myself in having houses. But if I had just cash or kept it in the bank, I'd spend it immediately. But not for stupid things. So I don't like to have money. I never have money in my pocket.

JPMorgan was already, for the most part. Our businesses at JPMorgan share the same cash-management systems. The commercial bank, the private bank, the retail bank, they all use the branches. The cash-management system moves the money around the world - for global corporations, and for you, the consumer, too.

All violence is injustice. Responding to violence with violence is injustice, not only to the other person but also to oneself. Responding to violence with violence resolves nothing; it only escalates violence, anger and hatred. It is only with compassion that we can embrace and disintegrate violence. This is true in relationships between individuals as well as in relationships between nations.

I like money, I love it, I use it wisely, constructively, and judiciously. Money is constantly circulating in my life. I release it with joy, and it returns to me multiplied in a wonderful way. It is good and very good. Money flows to me in avalanches of abundance. I use it for good only, and I am grateful for my good and for the riches of my mind.

So: if the chronic inflation undergone by Americans, and in almost every other country, is caused by the continuing creation of new money, and if in each country its governmental "Central Bank" (in the United States, the Federal Reserve) is the sole monopoly source and creator of all money, who then is responsible for the blight of inflation? Who except the very institution that is solely empowered to create money, that is, the Fed (and the Bank of England, and the Bank of Italy, and other central banks) itself?

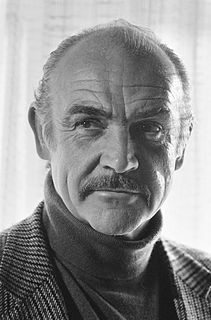

After I began to make some money, my brain-damaged accountant put me in one business after another that went bad. The only one that panned out was a small bank, an old Scottish firm with London offices in Pall Mall. I was a director. We sold out to a larger bank. That was the only successful venture I've had, apart from acting.

Then came the second Amsterdam discovery, although the principle was known elsewhere. Bank deposits...did not need to be left idly in the bank. They could be lent. The bank then got interest. The borrower then had a deposit that he could spend. But the original deposit still stood to the credit of the original depositor. That too could be spent. Money, spendable money, had been created. Let no one rub his or her eyes. It's still being done-every day. The creation of money by a bank is as simple as this, so simple, I've often said, that the mind is slightly repelled.